The United States and China have agreed to enter a meaningful 90-day trade pause as of May 2025 in order to de-escalate the longstanding tensions and provide both economies a bit of pause. The agreement, which was made on May 12, 2025, involved reciprocal tariff reductions and an overall framework to continue negotiations.

📜 Key Provisions of the 90-Day Trade Truce:

Tariff Reductions:

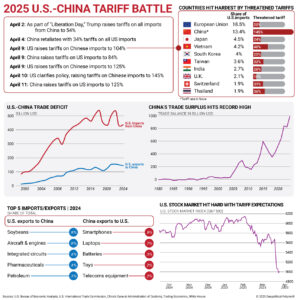

United States: For 90 days, the U.S. suspended 24 percentage points of the additional ad valorem duty on Chinese imports reducing the tariff rate from 145% to 30%.

China: For 90 days, the Chinese tariff on U.S. goods was also lowered, reducing their tariff on U.S. goods from 125% to 10%.

Non-Tariff Measures:

-

China agreed to suspend or remove non-tariff countermeasures taken against the U.S. since April 2, 2025.

- U.S.–China Tariff Truce

- 90-Day Trade Agreement

- Trump Tariff Strategy

- Reciprocal Tariffs

- Strategic Uncertainty in Trade

📈 Economic Implications:

The reductions of tariffs have provided short–term relief, to some extent, to many sectors and some businesses, including consumer goods, healthcare, and technology. However, many still feel uncertain about the most effective next step, as the truce is temporary and policy may change again.

Agricultural Concerns:

Farmers in the United States, especially those in soybeans, have concerns over the timing of the truce. It ends just before the fall harvest. U.S. farmers have lost market share to Brazil and others in the past due to trade disruption.

Market Reactions:

Financial markets initially responded positively to the announcement, with stock indices experiencing gains. However, the temporary nature of the agreement has led to continued volatility and uncertainty among investors.

🏭 Sector-Specific Impacts

Manufacturing:

-

Manufacturers like Komatsu anticipate significant cost savings due to the tariff reductions, estimating relief of up to $140 million.

-

Retailers such as Walmart and Target are monitoring the situation closely, with concerns about potential price increases if tariffs are reinstated.

🔍 Broader Economic Context:

Inflation and Consumer Spending:

: Although economists believe that the lower tariffs may help reduce inflation risks in the short–term, it remains uncertain how much resilience consumer expenditure will retain due to consumer confidence being fragile.

Supply Chain Issues:

: Businesses are reviewing their supply chains, and some are considering diversification strategies to diminish reliance on China for manufacturing. However, infrastructure gaps and complications related to higher costs in alternative locations will continue to create barriers for businesses.

Future considrations:

The 90-day truce is intended to be a temporary solution to relieve immediate economic pressures, however a long-term solution depends upon the outcome of current negotiations and the willingness of both countries to resolve trade issues underlying their disputes.

For businesses and investors, the idea is to remain watchful and flexible due to the likelihood of rapid policy changes and the ongoing global trade landscape.

-

Made in China 2025 Initiative

-

Supply Chain Diversification

-

Section 301 Tariffs

-

Section 232 Tariffs

-

Fentanyl-Related Tariffs

-

China Plus One Strategy

Recent Developments:

-

U.S. and China Hold First Call Since Geneva. Why It’s a Good Sign for Trade Talks.

-

Will Trump’s tariff climbdown save the US from recession?

-

Farmers fear Trump trade winds could damage crops: ‘It’s unnerving’